Make a Donation

Habitat for Humanity Susquehanna relies on financial and in-kind support to continue our mission of helping low-income families maintain their homes and/or become homeowners. Currently only 4% of our building materials are donated, the remaining 96% are purchased through financial donations. Your financial support to Habitat for Humanity Susquehanna keeps your charity dollars local. Local giving is a win win for us all, improving our neighborhoods and home values through home ownership.

Other Ways To Give

Great news! Community Investment Tax Credits (CITC) are available.

How does this work?

Maryland tax credits are available to our donors to specific revitalization programs. To get the credit, your donation must be at least $500. Let’s say you are super generous and donate $1,000, you will get a tax CREDIT for half the amount, or $500 off your State taxes. But there’s more! You still get tax deduction for the full thousand, so assuming a tax bracket of 25%, you get a deduction worth $250. Combining them, you have given Habitat $1,000 but the true cost to you was only $250, since you received $750 in tax savings.

Both businesses and individuals are eligible. You can make the donation in one lump sum, in installments, through payroll deductions, or even by appreciated stock.

TO QUALIFY FOR A CREDIT ON YOUR 2022 TAXES, YOUR DONATION AND FORM NEED TO BE DATED AND RECEIVED BY DECEMBER 31, 2022. DONATIONS AFTER THAT DATE WILL QUALIFY FOR THE 2023 TAX YEAR.

We typically sell out of these credits quickly, so please contact Yvonne Golczewski at ygolczewski@habitatsusq.org. Thank you!

Click here to download the CITC donation form.

Donate by Mail

Habitat for Humanity Susquehanna

205 S. Hays Street, Bel Air, MD 21014

Donate by Phone

(410) 638-4434

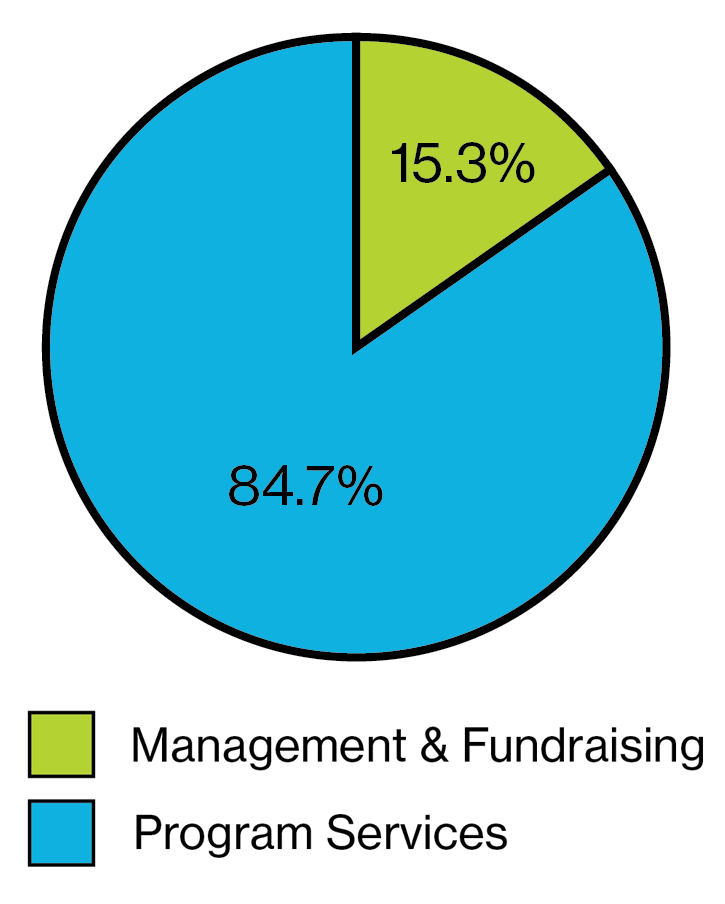

We Exceed the BBB's Wise Giving Alliance Standards!

The Better Business Bureau (BBB) Wise Giving Alliance says that, at a minimum, 65% of all money raised through charity should go to program activities. In fiscal year 2020, over 84% of all funds raised at Habitat for Humanity Susquehanna went to program activities.

Charitable Deductions

By making a donation in the form of stocks, bonds, mutual funds or other appreciated securities, you are making an investment in the future of our partner families and in our community.

As a donor, you are entitled to take a charitable deduction for the full fair-market value of appreciated securities held longer than one year, and you usually avoid paying the capital gains tax that would be due if you sold the securities.

We will provide you with a receipt for your tax records. Typically, our agency determines your gift date by the date the securities enter our account.

To transfer your security to our agency, please contact Ola Boswell at oboswell@habitatsusq.org.

Thank you for your generous contribution.